Construction Books

-

Concrete & Formwork -

Calculated Industries Construction Master Pro Workbook and Study Guide -

Building Layout -

Home Inspection Handbook -

Pipe & Excavation Contracting Revised -

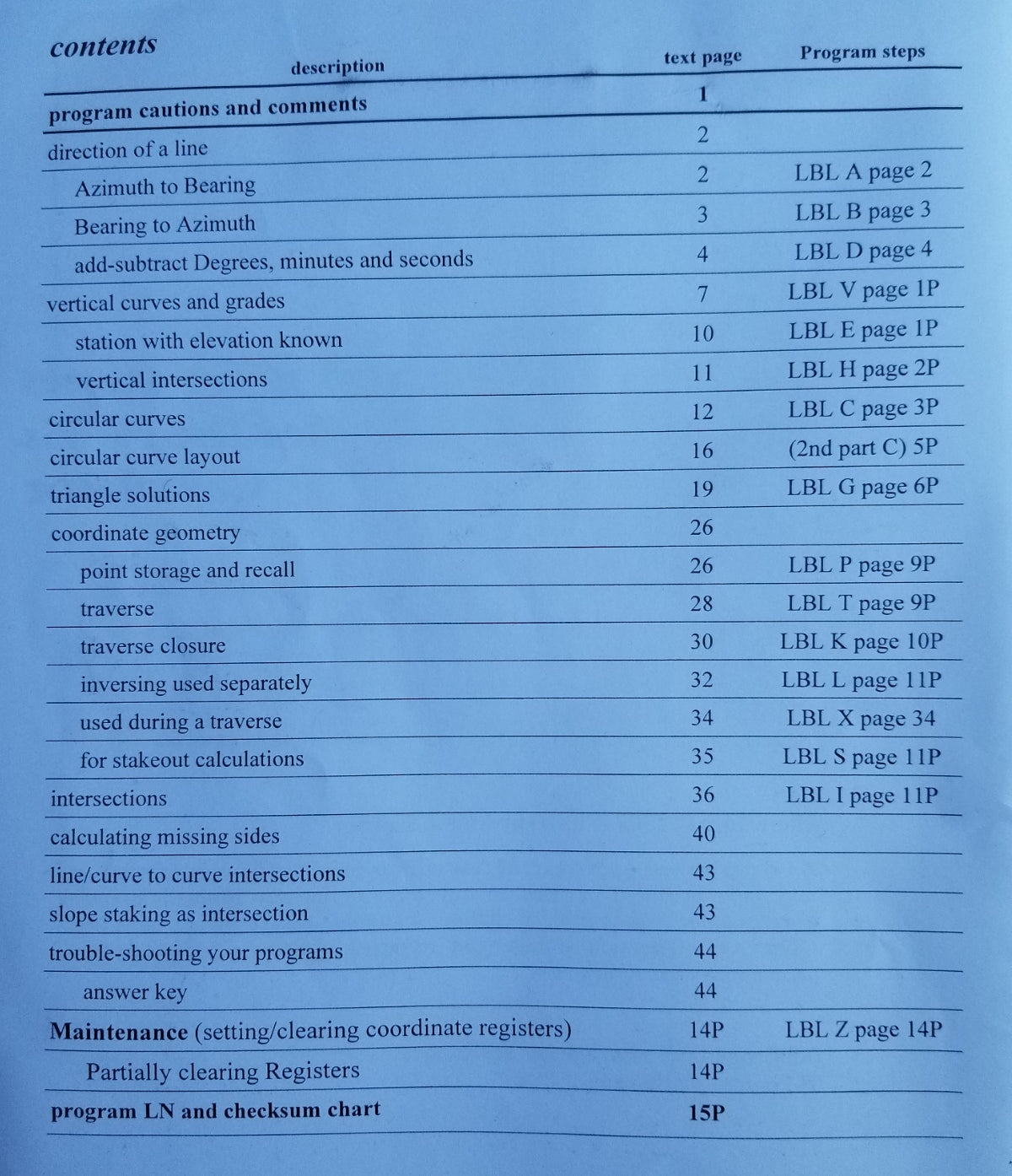

D'Zign Surveying Solutions Book for the HP35s - Allowed on NCEES Tests! -

2026 National Building Cost Manual -

2026 National Construction Estimator -

2026 National Electrical Estimator -

2026 National Painting Cost Estimator -

2026 National Plumbing & HVAC Estimator -

2026 National Renovation & Insurance Repair Estimator -

2026 National Repair & Remodeling Estimator -

2026 National Home Improvement Estimator -

D'Zign Surveying Solutions Book for the HP33s - Allowed on NCEES Tests!